What Does DRC Stand For & Mean For Your Service Business?

March 1, 2023 | Read: 5 minutes

If you’re wondering “What does DRC stand for?” you’ve come to the right place.

Important changes occurred in 2021 and it’s useful to understand what VAT: Domestic Reverse Charge (DRC) means for your service business.

Let’s explore all you need to know:

Below, we’ve highlighted exactly what DRC means.

While it’s true that VAT changes and finance aren’t often super exciting topics to explore, changes to tax law are of great importance.

As ever, it helps to be aware of what the DRC changes mean and how your business can comply with the law.

We’ve listed information that covers the basics to better explain exactly what does DRC stand for.

We’ve also explored—should DRC affect your business—how you can ensure compliance with these rules.

Subscribe

Join our Newsletter to receive regular updates!

1. What does DRC stand for?

To be clear DRC stands for Domestic Reverse Charge.

On 1st March 2021, new rules came into effect that changed the way VAT could be collected in the building & construction industry.

The changes mean that the customer receiving a service will have to pay the VAT that is owed to HMRC, rather than paying it to the supplier, who’d previously have paid HMRC on their behalf.

In turn, the customer can recover the VAT, subject to the normal rules.

These changes are now a legal requirement, so you should ensure your business is compliant.

2. How do DRC changes impact my business?

DRC was implemented in an effort to fight and reduce fraudulent behaviour.

There are instances where companies have taken VAT that’s been paid to them by a customer (that’s then meant to go to HMRC), but been held on to as “profit” that isn’t legally theirs to keep.

Changes like this inevitably impact a business. That’s whether it means:

- Disrupting the status quo

- Creating additional admin

- Regularly updating your policies (i.e. GDPR privacy updates)

However, if you’re prepared, the impact will be minimal.

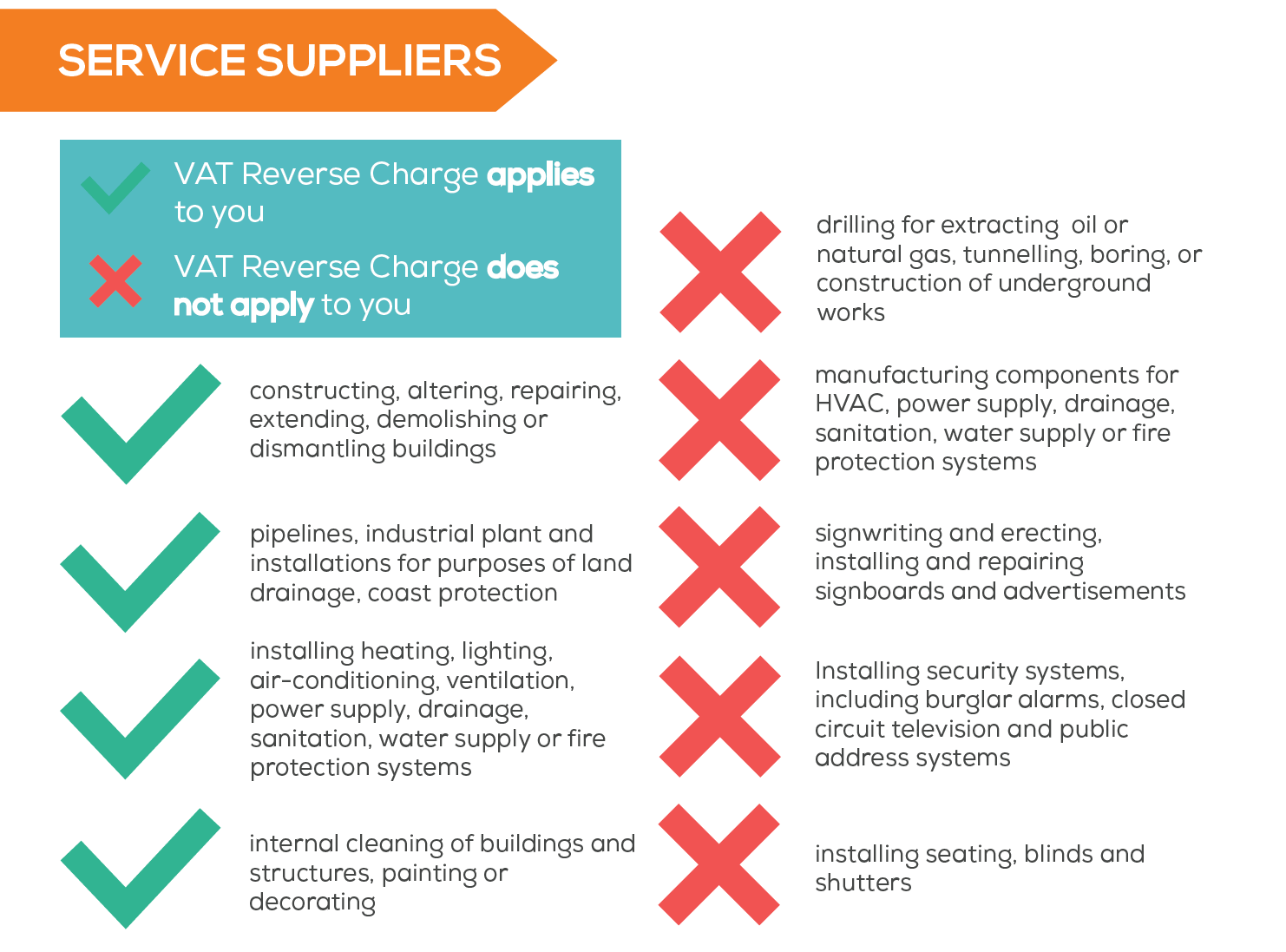

These changes will affect a variety of field service businesses and be influenced by the services you do or don’t provide.

An easy way to know if your business/service is affected by domestic reverse charge is by noting whether you’re registered to supply or receive services under the Construction Industry Scheme (CIS).

There are exceptions, but you can check those listed on HMRC and see others explained in our list, below:

HMRC acknowledged that the implementation would likely cause some difficulties. It even delayed the original launch date twice, and implemented DRC on 1st March 2021, instead.

They also stated that for the first 6 months they’d apply:

A light touch in dealing with any errors made […] as long as you are trying to comply with the new legislation and have acted in good faith.

Now, businesses should be well prepared to do everything in their power to remain compliant (more on that below), but it was certainly a useful boon to know there was a decent period to adjust.

3. What should I do about Domestic Reverse Charge?

By now, you should be compliant. All preparations should have been completed by the 1st March 2021.

The actions you needed to take will depend on the type of business you run and what sort of services you’re involved in offering.

Different rules apply for Contractors, Subcontractors, and companies who either are or aren’t listed under CIS.

HMRC states the following when it comes to whether you’re a contractor or sub-contractor and what you need to do to be ready:

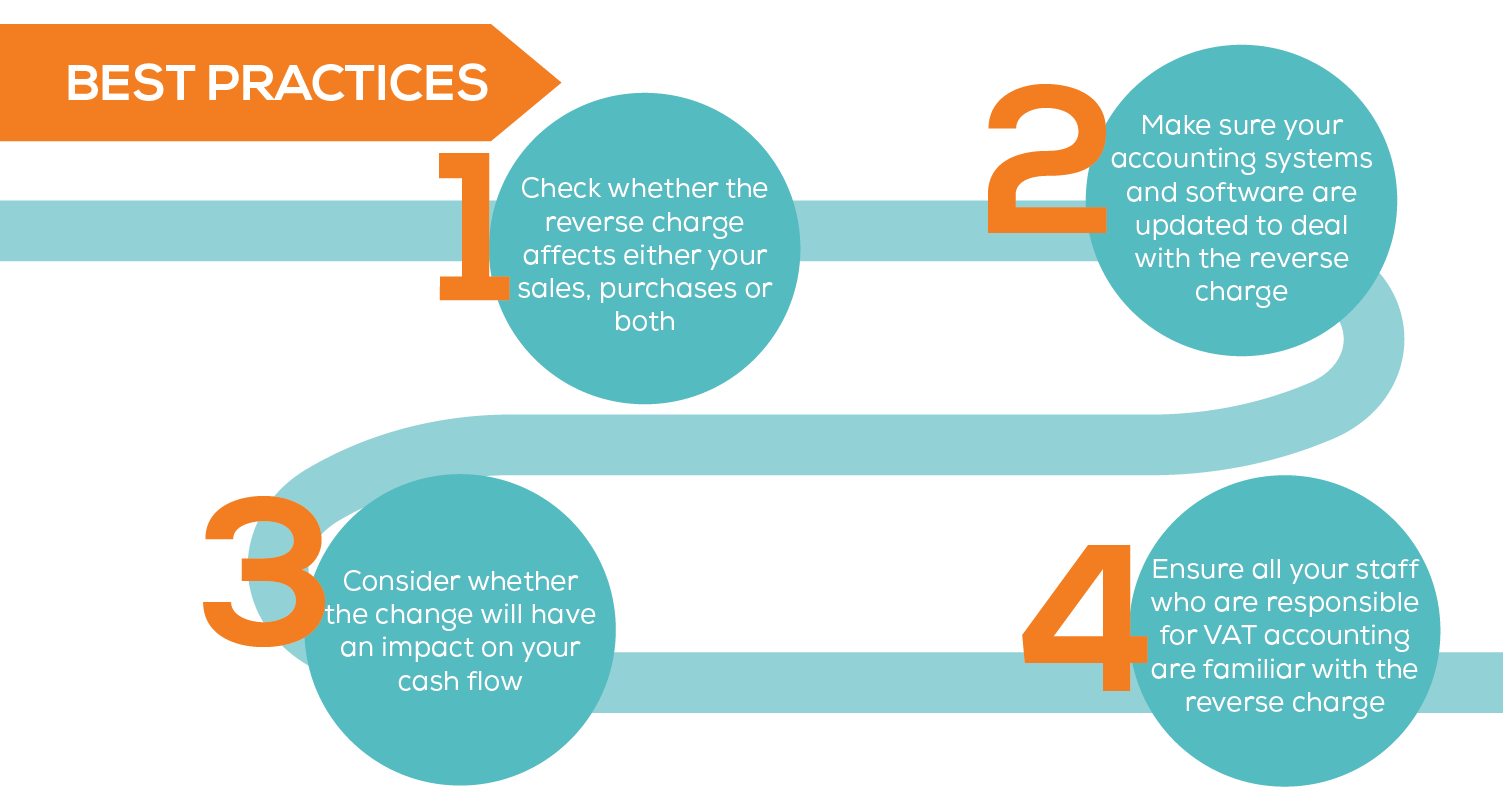

Below, we’ve listed the four best practices to keep in mind when preparing for DRC:

- Check whether the reverse charge affects either your sales, purchases, or both.

- Make sure your accounting systems and software are updated to deal with reverse charge.

- Consider whether the change will have an impact on your cash flow.

- Ensure all your staff who are responsible for VAT accounting are familiar with the reverse charge.

4. Who should I talk to if I have more questions?

In short, speak to HMRC and your accountant.

If you’re using invoicing software to manage your payments and VAT, definitely speak to colleagues with financial expertise. They should know how to help you prepare, too.

Follow the link for more info on Domestic Reverse Charge VAT on HMRC.

For the latest updates, be sure to bookmark the page and check for further updates.

In addition, you should also watch their Webinar. A visual aid is often more helpful alongside written content alone. It’s an informative session and a great way to get up to speed.

The changes are a legal requirement, so compliance is now a requirement, as of 1st March 2021.

To explore the changes in even more detail, we worked with Crunch Accounting to explain even more about Domestic Reverse Charge.

Subscribe to stay in the know!

If you’d like to keep up with more industry news, as well as receive frequent updates by email, then subscribe to our newsletter.

Every two weeks we share a variety of interesting articles, free resources, videos, and other content to help you out. Click to subscribe and join us, today!

For additional tips and field service management software advice, you’ll never miss a beat by subscribing to the newsletter!

The Commusoft UK Newsletter

Subscribe to get fortnightly updates delivered right to your inbox!