On Site Invoicing

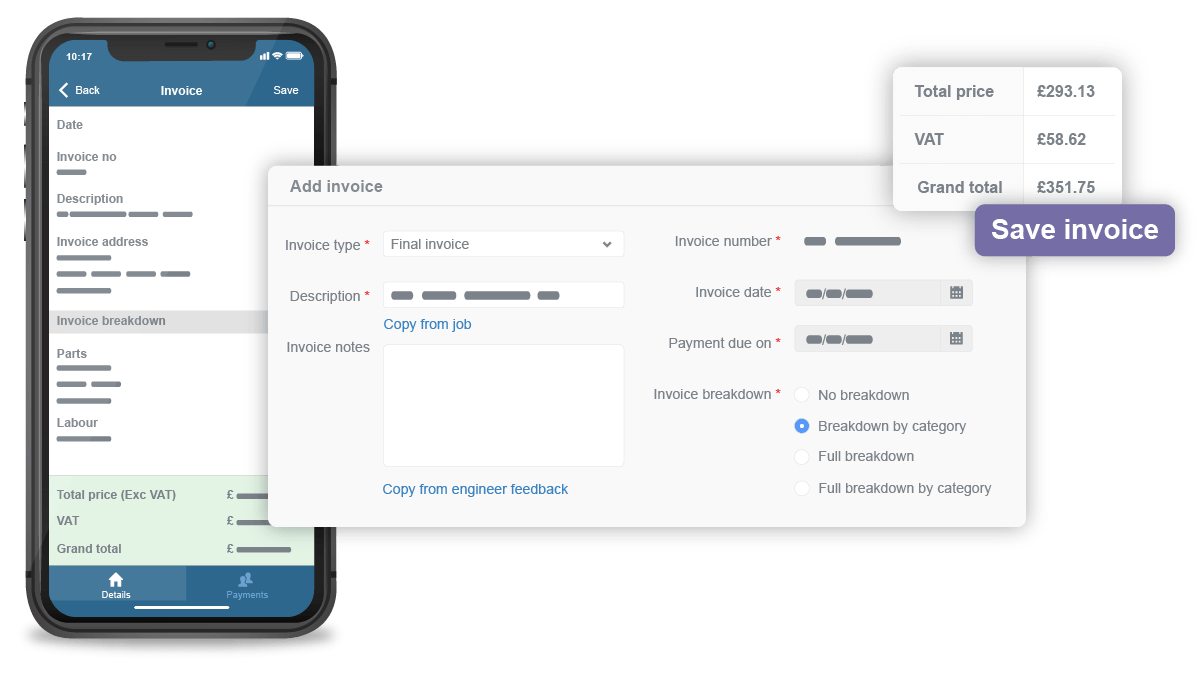

Accelerate your cash-flow; engineers can request or accept payments directly from the field on our job invoice app.

Professional invoicing software helps the best trades businesses stand apart. With Commusoft's invoice platform, you can empower customers with convenient self-service payment options. Whether you serve residential or commercial clients, digital invoicing ensures your team provides expert solutions, so you can get paid quicker!

Accelerate your cash-flow; engineers can request or accept payments directly from the field on our job invoice app.

Set jobs to automatically send an invoice as soon as an engineer marks the job “complete”.

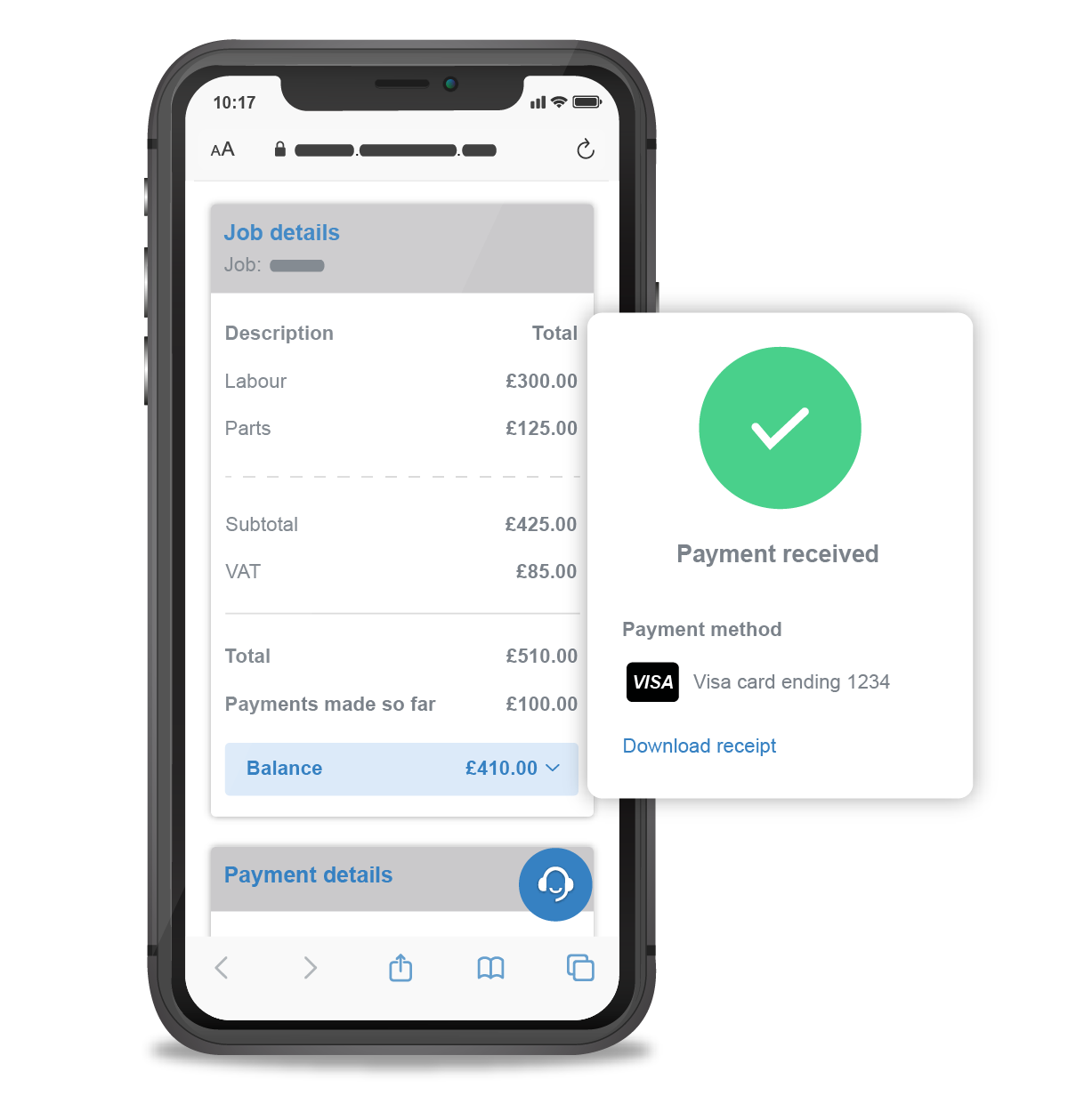

Let customers pay when it’s convenient for them. Accept payments any time of day with our self-service invoicing portal.

Personalise your invoices with your company logo, colours, and unique accreditations.

Condense invoices for multiple jobs into one and ensure no payments are missed.

Commusoft syncs with a variety of accounting integrations, including Quickbooks, Xero, and Sage.

Lisa

Office Manager

A & S Kingdon Ltd

We get invoices out much quicker to customers and get paid faster too – sometimes paying the same day!

Go beyond sending simple bills by centralising your records and documents in one comprehensive platform. Create templates for every service you offer, and customise them with pricing and line items, images, company branding, and more. Plus, your team will always be aware of jobs that need to be billed, outstanding statements, and payments accepted. This way, you can focus on generating bigger, and consistent, company profits instead of mulling over paperwork.

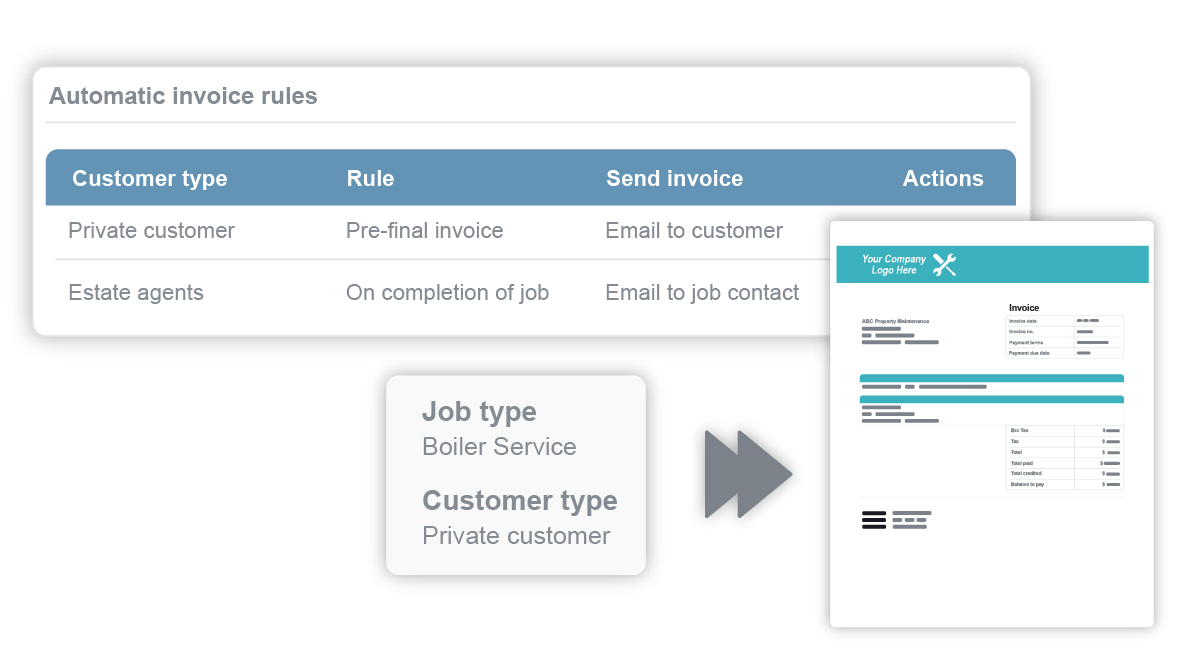

Tired of manually creating and sending invoices? Automate the process; nothing is faster or easier! You’re in control, you can customise which invoices are automated, based on the rules you choose. Even more, you can maximise productivity by creating automated debt-chasing and invoice payment receipt workflows. Not only does automation help your team get paid faster, but it also frees admins to handle bigger tasks. These features are available on our Customer Journey plan.

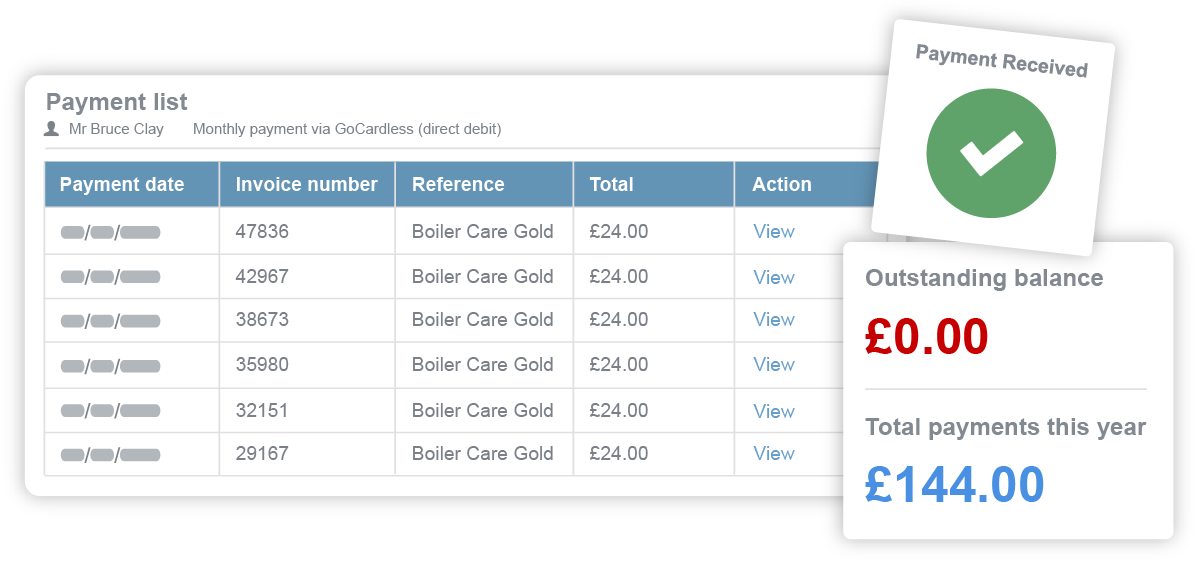

Commusoft users can create reliable revenue streams by offering routine payment plans. With direct debit through GoCardless, you simply select how often you want to get paid and the amount. This system enables you to get paid consistently throughout the entire year, meaning you won’t have to worry about the slow season.

A digital payment portal is an efficient way for commercial and residential customers to compensate your business. Your team can email them a link to a personalised self-service statement portal, where they can see all outstanding invoices and pay online. Offering convenient ways to pay ensures you can complete jobs quicker and get paid sooner!

Send your self-service payment portal link to customers after jobs for quick turnarounds! If you prefer emails, Commusoft generates PDF versions of all invoices.

Grow brand awareness with your customers! Commusoft invoices can be customised to include your logos, accreditations, and brand colours.

Combine multiple jobs across multiple sites into one invoice. This is great for property maintenance companies or customers with many properties.

A custom statement portal enables commercial customers to review any unpaid invoices any time of day, and allows them the option to settle one or multiple bills simultaneously.

Commusoft can automatically generate and send invoices for your annual contracts. This works in conjunction with our service contracts feature.

We'll take care of the small details. Linked Commusoft and accounting system sync every 2 hours, removing double data entry or forgetting to manually update important terms to either system.

Digital invoices reach customers sooner and offer a convenient way for customers to pay any time of day; this means your team can get paid faster, with less effort. Further, commercial clients can access invoices via a personalised self-service statements portal.

Whatever the occasion, your team can easily build and send a variety of invoices with Commusoft!

As soon as your engineer marks a job as “complete”, your office staff will be notified and can send an invoice that’s prefilled with the customer’s personal and job details straightaway.

If you want to send invoices even faster, you can set up automated invoices for certain job types. These invoices will be automatically sent to customers as soon as your engineer marks a job “complete”.

Even more, we offer customisable workflow templates! Effortlessly track outstanding debts and send automatic payment reminders to customers, or automatically send receipt emails following accepted payment.

Automated invoicing and workflows are available on our Customer Journey plan. Schedule a call today, and see how Commusoft can help you get paid faster!

Commusoft integrates with accounting software including Quickbooks Online, Xero, Sage Accounting, and a variety of communication, business, and supplier integrations too!

Want to transform your credit card payments? Check out Instant Bank Pay with our GoCardless Integration!

Check out all our integrations!

Our invoicing software pricing depends on how many licenses you need, and which of our powerful plans you choose.

Learn more about each of our plans and choose the best solution for your team!

If you work a 40 hour week, you can spend up to 4 hours invoicing! And that’s all without factoring in other necessary admin tasks.

Getting paid can often the most satisfying part of the job, as it's the well-deserved reward for a job well-done. This is how you can speed things up!

Discover how Commusoft's GoCardless integration helps trades businesses drastically reduce credit card fees thanks to Instant Bank Pay!